Great Suggestions For Selecting Gold Price Charles Iii

Great Suggestions For Selecting Gold Price Charles Iii

Blog Article

What Should I Consider Before Making A Decision To Invest In Gold Bullion Or Coins?

Understand the tax implications associated when you purchase and/or sell gold in Czech Republic. Gold investment could cause tax implications that are different, which could impact your returns. Market Conditions- Be aware of trends in the market and any fluctuations in the gold price. You'll be able to make better decisions knowing what you can anticipate.

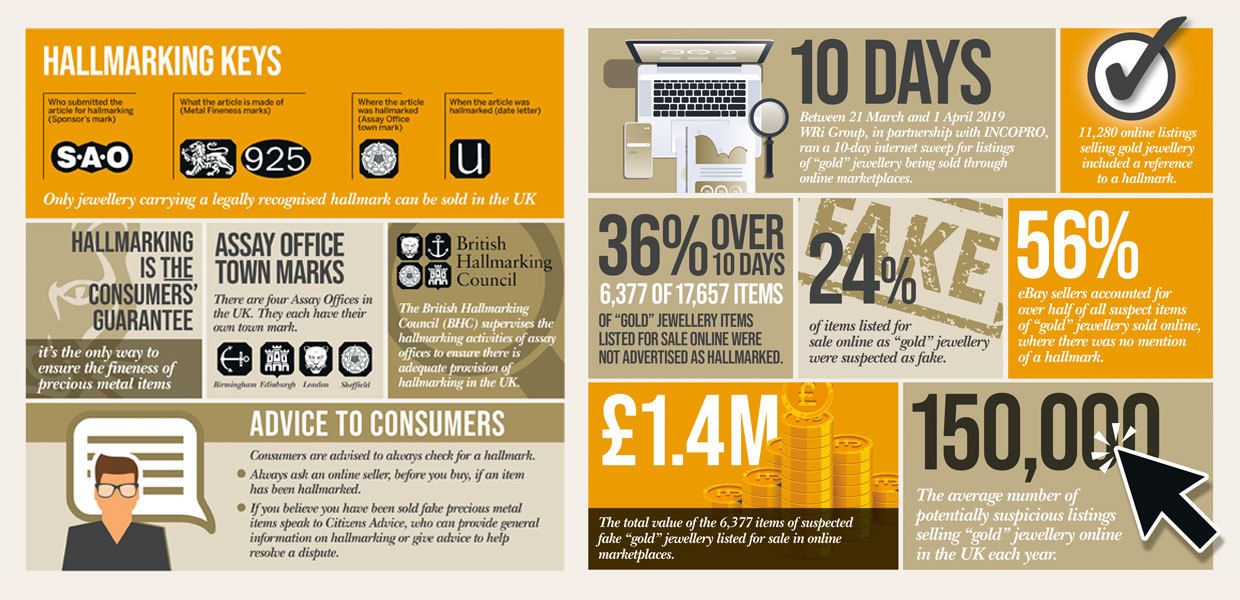

Authenticity: Be sure to verify the authenticity of any gold coins or bullion prior to purchasing.

Purpose of Investment- Clarify your investment goals. You should decide whether you want to buy gold as a longer-term investment, as a portfolio diversification or to protect against inflation.

Research or Consultation- Contact experts and financial advisors as well as experts in precious metals to get guidance. Research thoroughly to discover more about the gold markets and make informed decisions regarding your investment.

Gold is a great investment. However, you should be sure to approach any investment, including precious metals with research and careful assessment. It is also important to understand your goals in terms of financial and the risk you are willing to take. Follow the top rated sell about Charles III gold bars for website recommendations including canadian gold maple leaf coin, purchase gold bullion, 1 ounce of silver, 2000 sacagawea dollar, double eagles, buy gold coins, 2000 p gold dollar, gold and silver dealers, 24 karat gold coin, 50 pesos gold coin and more.

What Can I Do To Determine Whether A Gold Product I Purchase Is Genuine And Has The Appropriate Documents?

Take these steps if you are looking to ensure that the gold you purchase is authentic and includes all of the required documentation.

Directly ask the seller regarding the paperwork that comes with the gold. Trustworthy sellers usually provide documents confirming authenticity or purity of their gold purchases. For more details, ask about the documents. The certificates should contain details on the item. For instance, it should include its purity in Karats (or the fineness) or weight, as well as the manufacturer.

Review the documents- Take care to examine the certificates or documents which accompany the gold. Make sure they contain the information of the seller, as well as the date of purchase, and any official seals or stamps that prove the authenticity of the certificate.

Check the authenticity of certificates and gold items. Examine the hallmarks, purity marks or other features that identify the item to confirm the information provided in the documents.

Verify the authenticity of the source- check authenticity of the issuing organization or the certification authority. Verify that it is an accredited assay bureau, a reputable government institution, or an accredited agency. Check out the best buy Bohemia coins advice for more tips including invest in precious metals, chinese coins, gold sovereign, kruger coin, gold morgan dollar, nationwide gold and bullion reserve, kruger coin, buy gold silver, gold etf vanguard, 100 grams gold biscuit and more.

What Is A Low Mark-Up To Stock Market Price And Low Price Spread For Gold?

In the context gold trading The terms low markup or low spread refers to the expense of purchasing and selling gold in comparison with the current market value. These terms are related to the amount you will spend on additional expenses (markup) in addition to as the gap between the price of buying and selling gold (spread). A low markup implies that the dealer charges just a slight price over the market value. A low markup occurs when the price you are charged for buying gold, is barely or not at all more than the market price at which it is currently.

Low Price Spread - The spread is described as the gap in gold's buying (bid) price and the selling (ask). The low spread price means that the gap between two prices is small which means there's a less gap between the gold price and the cost to sell it.

How Much Does The Markup And Price Difference Between Gold Dealers Vary?

There are a few general elements that can affect the price of gold. These are business models, operational costs, reputation and pricing strategies. There are numerous factors that can affect the price spreads and mark-ups for gold. Conversely, newer or less-established dealers may offer less mark-ups in order to draw customers.

Business model and overhead costDealers that offer premium services or physical stores might have higher overhead expenses to pay for. They therefore increase their prices to make up for the cost. Online sellers or those who are operating at a lower cost could provide a more competitive price.

Pricing Transparency. Dealers that offer transparent pricing are less likely to charge markups.

It is important for gold investors, given these factors that they conduct thorough study to compare prices, and look at other factors such as reputation, reliability and customer service when selecting a seller. Shopping around and seeking quotes from a variety of sources can help you determine the most the most competitive prices for buying gold. Take a look at the most popular gold bullion Maple Leaf hints for site tips including 1 oz gold coin price today, gold bullion price, gold ira best, sell gold coins, british sovereign gold coin, 1 oz gold, gold investment companies, 100 gm gold biscuit, gold and silver dealers near me, gold buffalo coin and more.